Understanding Fraud and Money Laundering: Methods and Implications

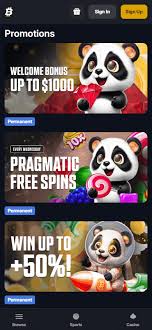

Fraud and money laundering are two interconnected crimes that have significant implications for economies and societies worldwide. The methods and technologies used by criminals are constantly evolving, making it imperative for individuals and businesses to stay informed about these activities. In this article, we’ll explore the core aspects of fraud and money laundering, their methodologies, and the efforts undertaken globally to combat these issues. For those interested in gaining insights into the complexity of financial fraud, websites such as Fraud and Money Laundering Through Crypto Casinos Bitfortune com can provide valuable resources.

Defining Fraud and Money Laundering

Fraud is commonly understood as any intentional deception made for personal gain or to harm another individual. It encompasses a broad range of activities, including identity theft, credit card fraud, and investment scams. On the other hand, money laundering is the process of concealing the origins of illegally obtained money, typically by passing it through a complex sequence of banking transfers or commercial transactions. This process allows criminals to enjoy the profits of their illicit activities while making it appear as though the money was legitimately acquired.

The Evolution of Fraud Techniques

As technology advances, so too do the methods employed by fraudsters. They often exploit the vulnerabilities of digital platforms. For example, phishing attacks involve the fraudulent attempt to acquire sensitive information—such as usernames, passwords, and credit card details—by masquerading as a trustworthy entity. Cybercriminals utilize sophisticated techniques to craft emails and websites that can easily deceive individuals into providing their information.

Another prevalent technique is social engineering, where fraudsters manipulate individuals into revealing confidential information by exploiting human psychology. This can occur through phone calls, fake websites, or even in-person interactions, blurring the lines between legitimate and illegitimate practices. Moreover, the rise of cryptocurrencies has introduced a new layer of complexity, as these digital currencies can be used to facilitate anonymous transactions that further obscure the origins of illicit funds.

Money Laundering: A Three-Stage Process

The process of money laundering typically unfolds in three stages: placement, layering, and integration. The initial stage, placement, involves introducing the illicit funds into the financial system. This could be done through various means, such as bank deposits, purchasing assets, or gambling.

Next is layering, where the objective is to obscure the origin of the funds. This might involve conducting a series of complicated transactions, often across multiple countries or accounts, to create a convoluted trail that makes tracing the money difficult for authorities.

The final stage is integration, where the laundered money is reintroduced into the economy as apparently legitimate funds. This can happen through investments in businesses or assets, allowing criminals to enjoy their ill-gotten gains without raising suspicion.

Global Impact of Fraud and Money Laundering

The ramifications of fraud and money laundering extend far beyond the individual or organization directly affected. They contribute to economic instability, reduce the efficacy of financial institutions, and undermine the integrity of markets. Moreover, they can facilitate other criminal activities, including drug trafficking, terrorism, and human trafficking, as the profits generated from these crimes often require laundering to be spent.

Governments and organizations worldwide have recognized the severe impact that financial crimes can have and have taken steps to combat them. Introduction of stringent regulations and the establishment of dedicated financial intelligence units (FIUs) have become common practices to detect and prevent money laundering and fraud.

Regulatory Measures and Prevention Strategies

In response to the growing prevalence of fraud and money laundering, an array of regulatory frameworks have been established. Entities within financial sectors are now required to implement know your customer (KYC) protocols, which help to verify the identity of clients and assess their risk profile. This is complemented by anti-money laundering (AML) policies that require businesses to report suspicious transactions that may indicate money laundering.

Moreover, technological advancements like machine learning and artificial intelligence are increasingly being utilized to detect anomalies in transaction patterns that could suggest fraudulent activity. By analyzing vast amounts of data, these technologies can flag unusual behaviors and transactions for further investigation, thereby helping to preempt potential fraud and money laundering.

Conducting Due Diligence

Proactive due diligence is a vital component in the fight against fraud and money laundering. Organizations are encouraged to conduct comprehensive assessments of their clients and business partners, scrutinizing their backgrounds, financial histories, and overall legitimacy.

Enhancing employee training is also essential. Employees at all levels should be familiar with identifying warning signs of fraud and understand the protocols for reporting suspicious activities. This creates a culture of vigilance and accountability within organizations, which can deter potential fraudsters.

International Cooperation

Given the transnational nature of fraud and money laundering, international cooperation is critical in addressing these crimes. Collaborative efforts between governments, regulatory bodies, and law enforcement agencies help to strengthen the fight against financial crime. Information sharing and coordinated investigations can lead to more effective outcomes in prosecuting offenders and seizing illicit assets.

The Role of Technology in Combating Financial Crime

Innovation in technology is continuously providing new tools for combating fraud and money laundering. Blockchain technology, for instance, offers a transparent ledger that can trace the movement of funds. This can create accountability and transparency that make it harder for criminals to disguise the source of their money.

Furthermore, the increasing use of biometric technologies, like fingerprint and facial recognition, adds an additional layer of security for financial transactions. These technologies make it more difficult for fraudsters to impersonate legitimate clients, thereby reducing the risk of identity theft.

Conclusion

The complex landscape of fraud and money laundering presents a significant challenge to individuals, businesses, and governments globally. Staying informed about the latest methods employed by criminals, coupled with proactive measures and technological advancements, is crucial in the fight against these illicit activities. The collaboration between sectors and nations, along with a commitment to regulatory compliance and ethical practices, can drastically diminish the impact of fraud and money laundering on society. As we continue to navigate these intricate issues, the development of more robust frameworks and technologies will play a fundamental role in enhancing the integrity of our financial systems.