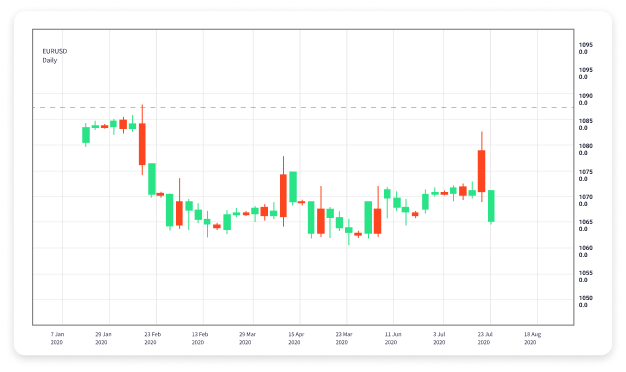

In the fast-paced world of forex trading, understanding market behavior is crucial for success. Traders often rely on a combination of analysis techniques and indicators to make informed decisions. If you’re looking to elevate your trading game, knowing the best indicators can make all the difference. In this article, we will explore some of the most effective indicators that professional traders use regularly, including insights on their application and how they can help improve your strategies. For more resources on trading, visit best indicators for forex trading Trading Platform VN.

1. Moving Averages

Moving averages are one of the most widely used indicators in forex trading. They provide a smoothed representation of price action over a specific timeframe, allowing traders to identify the direction of the trend more clearly. There are two main types of moving averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA). While SMA calculates the average price over a set number of periods, EMA gives more weight to recent prices, making it more responsive to current market movements.

Traders often use moving averages in conjunction with other indicators to confirm trading signals and improve their strategies. For example, when the short-term moving average crosses above a long-term moving average, it can indicate a potential bullish trend (this is known as a Golden Cross). Conversely, a bearish trend may be suggested when the short-term moving average crosses below the long-term moving average, referred to as a Death Cross.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. The RSI ranges from 0 to 100 and is typically plotted over a 14-day period. A reading above 70 indicates that an asset may be overbought, while a reading below 30 suggests it may be oversold. Traders use these levels to make decisions regarding potential reversals or continuations in trends.

RSI can be particularly helpful for identifying divergences, where price movements diverge from the RSI, potentially signaling an upcoming trend reversal. For instance, if prices are making higher highs while the RSI is making lower highs, it could indicate a weakening trend.

3. Moving Average Convergence Divergence (MACD)

The MACD is another popular trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period EMA from the 12-period EMA. The result is the MACD line, and a nine-day EMA of this result is the signal line.

Traders look for crossovers of the MACD line and the signal line as potential buy or sell signals. A bullish signal occurs when the MACD line crosses above the signal line, while a bearish signal occurs when it crosses below. Additionally, histogram bars indicate the distance between the MACD line and the signal line, providing insights into the strength of trends.

4. Bollinger Bands

Bollinger Bands are a volatility indicator that consists of three lines: a middle line, which is a simple moving average, and two outer bands that represent the standard deviation from this average. When the price is close to the upper band, it may indicate that the market is overbought, while the lower band suggests it may be oversold.

Traders can use Bollinger Bands to identify potential breakouts or reversals. If the price breaks above the upper band, it may signal potential further upward movement, while a break below the lower band could suggest downside potential. Furthermore, during periods of low volatility, the bands will constrict, signaling a potential increase in volatility ahead.

5. Fibonacci Retracement

Fibonacci retracement levels are based on the Fibonacci sequence and are used by traders to identify potential support and resistance levels. By plotting key Fibonacci levels on a chart (such as 23.6%, 38.2%, 50%, 61.8%, and 100%), traders can predict areas where prices might retrace before resuming their original trend.

This tool is particularly effective in trending markets, as price often respects these levels. For example, if an asset has been trending upward and then begins to pull back, traders will often look for price to find support at the Fibonacci levels before continuing its upward trajectory.

6. Stochastic Oscillator

The Stochastic Oscillator is another momentum indicator that compares a particular closing price to a range of prices over a specific period. The indicator ranges from 0 to 100 and is usually plotted with two lines: %K and %D. The %K line is the main line, while the %D line is a moving average of the %K line.

Traders use the Stochastic Oscillator to identify overbought and oversold conditions, typically setting the overbought level at 80 and the oversold level at 20. Crosses between the two lines can also indicate potential buy or sell signals, especially when the oscillator reaches extreme levels.

7. Average True Range (ATR)

The Average True Range (ATR) is a volatility indicator that measures market volatility by decomposing the entire range of an asset for a given period. Unlike moving averages, ATR does not indicate price direction; instead, it helps traders determine potential price movement based on historical volatility.

ATR is especially useful for setting stop-loss levels. By analyzing ATR readings, traders can ascertain a sensible stop-loss distance, allowing for adequate movement while limiting risk. A higher ATR value suggests higher volatility, while a lower ATR indicates a more stable market.

Conclusion

Selecting the right indicators is crucial for successful forex trading. While no single indicator is foolproof, using a combination can provide a more comprehensive view of market conditions and potential price movements. It’s essential to practice proper risk management and continuously educate yourself on market behavior and analysis techniques. By integrating these indicators into your trading plan, you can enhance your decision-making process and potentially increase your profitability in the dynamic world of forex trading.