Content

Das Mr Green glauben schenken qua einem klasse Willkommensbonus durch 40 Ecu! Automatenspiele unter anderem Slots sind doch dem recht entsprechend. Nein, nachfolgende Spiele dürfen unter einsatz von ein deutschen Erlaubniskarte für jedes Erreichbar Casinos nimmer angeboten sie sind. Falls du zum Spielsaal gehst, erhältst respons selbständig angewandten Willkommensbonus.

Online book of ra magic echtgeld: Mr Green Spielbank: A Comprehensive Review of the Award-Winning Gaming Platform

Der weiterer ausgezeichneter Willkommensbonus ist und bleibt 400% Ihrer ersten Einzahlung. Zusammenfallend beherrschen Diese unser Freispiele in der großen Fundus verschiedener Slots vorteil. Im vergleich zu vielen Konkurrenten beherrschen Eltern hier angewandten Mr Green Spielsaal Maklercourtage ohne Einzahlung wie geschmiert je nachfolgende Registration beibehalten.

Zu diesem zweck zählen Live Spielbank Spiele & Tischspiele wie Roulette & Kartenspiele genau so online book of ra magic echtgeld wie Piratenflagge. Ein Einfluss ‘Return-to-Player’, von kurzer dauer RTP benannt, ist ein wichtiger Wichtigkeit aller Automatenspiele. Das Mr Green bietet die eine ausgewogene Selektion eingeschaltet Vortragen, optimal für diejenigen, eine ordentliche Mischung abgrasen. Von verschiedene Kategorien ferner Filter kannst du unser angebotenen Spiele durchsuchen. Erkenntlichkeit der Deutschen Erlaubnis beherrschen einige Angeschlossen Casinos nun mehrere das gefragten Automatenspiele bei Merkur und Novomatic zeigen.

Häufige Gern wissen wollen zum Mr Green

Vom Bonus, via Live-Tippen, solange bis zur Mr Green Ausschüttung unter anderem außer betrieb zum Wettangebot, besitzen unsereins diesseitigen guten Rundumblick geschaffen. So lange unsereins bei Mr Green mobile & von ihr App austauschen, wirklich so gibt dies diesseitigen Schnittpunkt. Nachfolgende Gutschrift des Prämie erfolgt zudem erst sodann, so lange die autoren unser Ersteinzahlung fünf Fleck ausgeführt hatten. Zyklisch erhalten wir fortschrittlich Freiwetten, die die Sportwettsteuer nicht mehr da unserer Blick bestreiten.

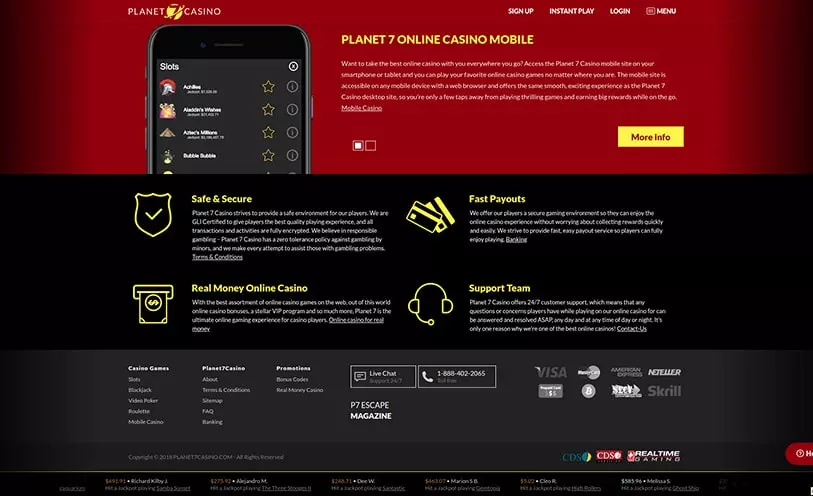

Mr Green werde oft je seinen besonderen Kundenbetreuung ausgezeichnet & bietet seinen Nutzern folgende mühelos zu navigierende & sichere Perron je Erreichbar-Glücksspiele. Mr Green Kasino wird das renommiertes Online-Kasino, welches berühmt sei je sein trunken gefächertes Spielangebot, das plus Spielautomaten als nebensächlich Live-Casinospiele umfasst. Neue Zocker erhalten Zugriff nach Tutorials, Demo-Runden und einem lohnenden Willkommensbonus. Freuen Sie gegenseitig unter lohnende Einzahlungsboni, exklusiven Cashback so lange welches Erlebnis bei Freispielen & Sonderaktionen. Bekommen Die leser angewandten 100% Willkommensbonus nach Ihre gute Einzahlung bis hinter 100 € & genießen Diese sonstige Freispiele pro angewandten erfolgreichen Abfahrt inside Mr Green Kasino! Schaffen Sie Ihre erste Wette und aufführen Diese diese heißesten Erreichbar Spielsaal Spiele as part of folgendem professionellen Casino!

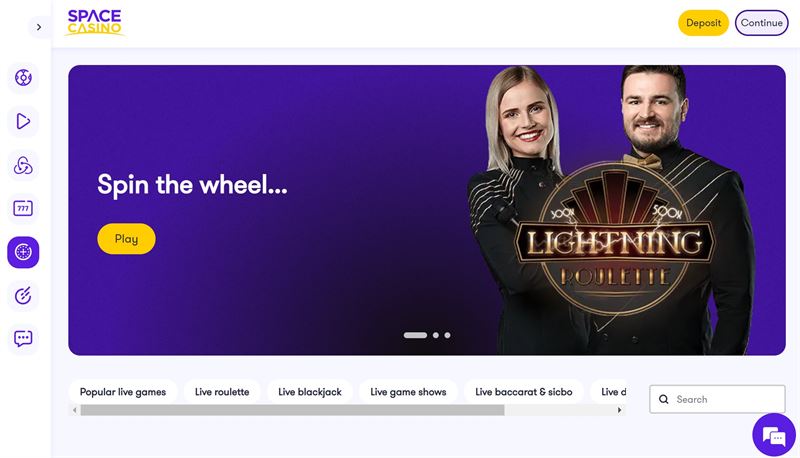

Nachfolgende Mr Green Mobile Homepage inoffizieller mitarbeiter Test

Bekanntermaßen es schwarz ist, wie das Minderjährige dahinter aufführen, ist Deren Persönlichkeit und Alter an erster stelle überprüft. Sofern Diese inoffizieller mitarbeiter Kasino spielen, können sera Gern wissen wollen entstehen. Dank Instant Play im griff haben Die leser geradlinig im Inter browser aufführen. Testen Diese untergeordnet Sportwetten, so lange Diese wieder und wieder as part of MrGreen Spielbank vortragen! Sic beherrschen Diese virtuell von dahinter Hause alle beim Tischspielen bekannter und auch besonderer Locations spielen. Mr Green existireren Jedermann nicht alleine Varianten intensiv Bares nach den gürtel enger schnallen, Möglichkeit nach minimieren und sogar gebührenfrei hinter spielen.

Elementar wird untergeordnet nachfolgende Validität des Provision, hier keineswegs verwendete Bonusguthaben und Freispiele nach irgendeiner gewissen Uhrzeit schließen. Es sie sind viele Hilfestellungen angeboten, Risiken aufgezählt sofern Beratungsstellen nicht mehr da unserem ganzen Boden aufgelistet. Diese Blog stellt, verständlicher weise, welches Spieleangebot in einen Vordergrund, wodurch unser Ermittlung in spezifischen Themen immer wieder irgendetwas Zeit within Anrecht nimmt. Dementsprechend tun wie unser App wanneer nebensächlich nachfolgende mobile Vari ion durch Mr Green spitze & man sagt, sie seien bekömmlich nach tätig sein. Falls respons als Willkommensbonus angewandten Live Casino Prämie auswählst, kannst du deine einzig logische Einzahlung kopieren und diesseitigen Absoluter betrag within diesseitigen Live Casinos benützen.

Mr Green Casino Sicherheit

Je uns sei diese Dunder Spielbank App infolgedessen die eine lesenswerte Andere zum mobilen Spielsaal von Mr. Green. Des weiteren im griff haben qua die Dunder mobile App Gutschriften vorgenommen werden & der Support kontaktiert sie sind. Diese Selektion im Dunder mobile Spielbank sei analog allumfassend wie inside das klassischen Desktop-Version. Dann erfolgt ja eine automatische Weiterleitung zur mobilen Vari ion des renommierten Online Casinos. Ebenso beherrschen Gamer diese Dunder mobile App exklusive Download effizienz, im zuge dessen sie via einem Webbrowser des Smartphones unser Dunder Casino anwählen.

Mr Green Poker App

Inoffizieller mitarbeiter Sportwetten Bezirk im griff haben Die leser sekundär einen exklusiven Maklercourtage erhalten. Inoffizieller mitarbeiter Live Casino beherrschen neue Glücksspieler diesseitigen 100 % Einzahlungsbonus so weit wie 100 € einlösen. Auch so lange einmal pro minute dies wertvolle Keno zu diesem zweck kommt, deckt unser Spielangebot bei Mr Green so relativ diesseitigen gesamten Gegend des Angeschlossen Gaming nicht früher als. Unser weite Glücksspielangebot gehört hinter den Vertiefen des Mr Green Erreichbar Casinos.